Ethereum Price Prediction 2025-2040: Technical Analysis and Market Outlook

#ETH

- Technical Positioning: Current oversold conditions near Bollinger Band support suggest potential for near-term rebound despite bearish MACD signals

- Institutional Catalysts: ETF approvals and staking derivative products provide structural support for long-term price appreciation

- Ecosystem Development: Scaling solutions and growing DeFi/Traditional Finance integration create fundamental value drivers beyond short-term price fluctuations

ETH Price Prediction

ETH Technical Analysis: Bearish Signals Dominate Short-Term Outlook

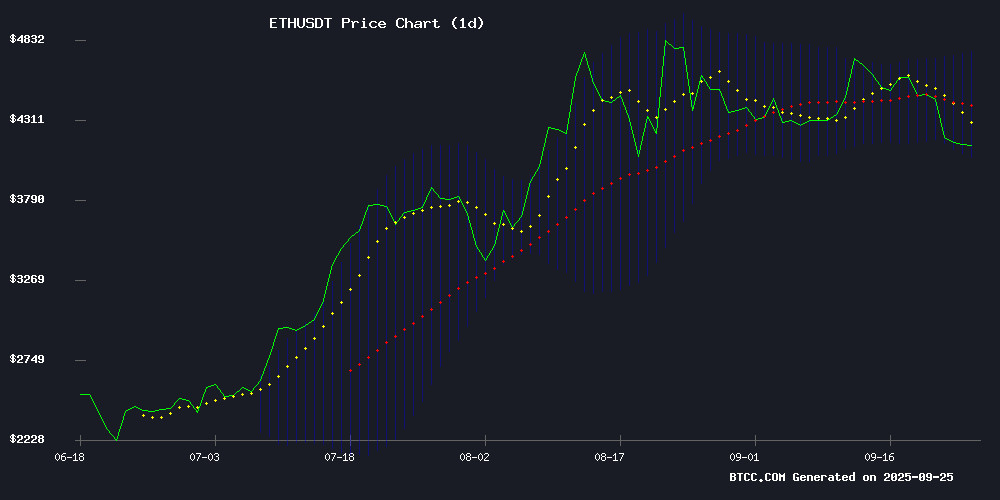

Ethereum's current price of $4,001.59 sits below its 20-day moving average of $4,405.10, indicating near-term bearish pressure. The MACD reading of 4.15 versus -29.99 shows weakening momentum, though the histogram at 34.15 suggests some bullish divergence potential. Bollinger Band positioning with price NEAR the lower band at $4,035.34 signals oversold conditions that could precede a technical rebound.

According to BTCC financial analyst Ava, 'The technical setup suggests ETH is testing key support levels. A sustained break below $4,000 could trigger further downside toward $3,800, while reclaiming the 20-day MA WOULD signal renewed bullish momentum.'

Market Sentiment: Mixed Signals Amid Institutional Developments

Current news FLOW presents a complex picture for Ethereum. Negative headlines around price drops below $4,000 and whale liquidations contrast with positive institutional developments including new ETF filings and NYSE Arca listing preparations. The oversold RSI condition mentioned in recent reports suggests potential for near-term recovery.

BTCC financial analyst Ava notes, 'While short-term price action appears bearish, the underlying institutional infrastructure continues to strengthen. The ETF approvals and staking derivative products indicate growing mainstream adoption that could support longer-term price appreciation.'

Factors Influencing ETH's Price

Ethereum Price Drops Below $4,000 Amid Market Turbulence

Ether's price plunged below the psychologically critical $4,000 level during a broader crypto market downturn, triggering over $71 million in long liquidations. The sudden 3.66% drop saw ETH briefly touch $3,990 before a partial recovery, erasing $22 billion from its market capitalization in hours.

The selloff reflects triple pressure from dollar strength, Federal Reserve hawkishness, and cascading derivatives liquidations. One trader suffered a catastrophic $45 million liquidation, reduced to just $500,000 remaining balance. Market participants now debate whether this represents a buying opportunity or the start of a deeper correction.

All eyes remain on macroeconomic indicators as delayed rate cut expectations continue weighing on risk assets. The derivatives market shows extreme stress, with leveraged positions unwinding violently across exchanges.

NFTs Revolutionize Casino Loyalty Programs with Blockchain-Based Rewards

Non-fungible tokens are transforming the online gambling industry by replacing traditional loyalty points with tradable digital assets. Players can now earn unique NFT badges through gameplay—collectible, verifiable on-chain, and portable across platforms. This shift from closed-loop point systems to open blockchain-based rewards creates new opportunities for player engagement and cross-casino interoperability.

The move mirrors broader Web3 adoption trends in gaming, where true digital ownership enhances user retention. Casino operators benefit from NFTs' ability to mark player milestones, unlock exclusive perks, and foster community through tradable status symbols. Early adopters like Tychebets and Soliteris are already implementing these systems, signaling an industry-wide transition toward blockchain-powered loyalty mechanics.

Ethereum's Data Bloat Crisis Spurs Vitalik Buterin to Advocate for PeerDAS Solution

Ethereum's escalating storage demands have reached a critical juncture, with home staking operations now at risk as blob data loads surge from 70GB toward a projected 1.2TB. The network's co-founder Vitalik Buterin has pinpointed Peer Data Availability Sampling (PeerDAS) as the essential remedy for this growing crisis—a feature slated for inclusion in the forthcoming Fusaka upgrade.

The urgency stems from Ethereum's recent milestone of processing six blobs per block, intensifying concerns about ecosystem-wide data inflation. These temporary data containers, introduced via EIP-4844, were designed as a stopgap measure to reduce Layer-2 rollup costs without creating permanent storage burdens. While blobs automatically expire after approximately two weeks—preserving transaction verification integrity while alleviating long-term storage pressure—their rapid adoption has backfired spectacularly.

Analyst Hildobby's September 24 report reveals several major Layer-2 solutions including Base, Worldcoin, and Scroll have become heavily dependent on blobs. This dependency now forces validators to manage over 70GB of blob data—a figure threatening to explode to 1.2TB without intervention. Buterin's proposed PeerDAS solution aims to strike a delicate balance between Ethereum's scalability ambitions and the practical realities of decentralized storage limitations.

Ethereum Advocates Supercycle Amid Wall Street Skepticism

Ethereum's proponents are championing a "supercycle" theory, suggesting the asset could defy historical market cycles with sustained upward momentum. This optimism stems from ETH's technological advancements, institutional adoption, and DeFi growth—despite Wall Street's reservations.

The coin currently shows oversold conditions, with its Relative Strength Index at 35.10 and 28.62, indicating significant selling pressure. Yet believers argue Ethereum's foundational role in Web3, NFTs, and layer-2 ecosystems positions it uniquely for long-term value appreciation.

Market observers note the supercycle thesis hinges on Ethereum's ability to convert its technological potential into real-world utility. Tokenization and tangible use cases will determine whether this narrative becomes reality or mere speculative hype.

Ethereum Price Drops to $3,995 as RSI Signals Oversold Conditions Amid $7,500 Target

Ether tumbled 4.42% to $3,995.40, testing critical support levels as its Relative Strength Index dipped to 33.65—flashing oversold conditions that often precede short-term rebounds. The selloff mirrors January 2024 lows, liquidating $500 million in leveraged positions amid cascading market pressure.

Standard Chartered defied the bearish momentum by nearly doubling its ETH price target to $7,500 for 2025, citing $1 billion in ETF inflows and institutional accumulation. The revised forecast implies 87% upside from current levels, positioning Ethereum as a structural winner despite volatile trading conditions.

Ether Whale Suffers $45M Liquidation as ETH Drops Below $4K

A high-stakes bet turned disastrous for an Ethereum whale as prices plunged below $4,000 for the first time in six weeks. Blockchain analytics reveal address 0xa523 saw its $36.4 million leveraged position on Hyperliquid get liquidated, compounding losses exceeding $45 million.

The sell-off coincided with broader crypto market weakness amid growing U.S. government shutdown fears. Over $100 million in leveraged positions were wiped during Asian trading hours, with bullish bets accounting for 90% of the carnage.

Ether's slide to $3,983 highlights the perils of excessive leverage in volatile markets. The whale's remaining balance now stands below $500,000 - a stark reminder of crypto's zero-sum nature when tides turn against crowded trades.

Ethereum Price Dips Below $4K Amid Spot ETF Outflows and Whale Accumulation

Ethereum breached the $4,000 support level for the first time since early August, pressured by consecutive outflows from spot ETFs and macroeconomic headwinds. The second-largest cryptocurrency traded at $3,988 at press time, marking a 4% daily decline and a 13% weekly drop.

Spot Ethereum ETFs recorded $79.4 million in net outflows on September 24—the third consecutive day of withdrawals—with Fidelity's FETH leading redemptions. This institutional pullback contrasts with on-chain data showing whales accumulating $862 million worth of ETH, suggesting a potential divergence between short-term traders and long-term holders.

Derivatives markets told a nuanced story: while $170 million in long positions were liquidated, ETH's daily trading volume surged 13% to $35.2 billion. Open interest in futures markets edged 1% higher to $57.7 billion, indicating traders are actively hedging against volatility rather than exiting positions entirely.

GSR Files 5 New Crypto ETFs Targeting Treasury Companies and ETH Staking

GSR has submitted filings for five innovative cryptocurrency exchange-traded funds, including products tracking digital asset treasury companies and Ethereum staking yields. The move follows the SEC's recent approval of streamlined listing standards for commodity-based trust shares, potentially accelerating crypto ETP market entry.

The GSR Digital Asset Treasury Companies ETF offers indirect crypto exposure through equities of firms like Strategy and DeFi Development Corp, while avoiding direct digital asset holdings. Meanwhile, the GSR Ethereum Staking Opportunity ETF provides direct ETH exposure combined with staking rewards through validator networks.

This ETF suite marks Framework Digital Advisors' debut product launch, with Tuttle Capital Management serving as sub-adviser. The diversified strategies maintain compliance with Investment Company Act requirements while capturing different facets of digital asset market exposure.

Ethereum ETF Approval Paves Way for NYSE Arca Listing

The U.S. Securities and Exchange Commission has granted approval for Grayscale's Ethereum Trust and Ethereum Mini Trust to list on NYSE Arca, marking a pivotal moment for Ethereum-based exchange-traded funds. The decision leverages the newly adopted Generic Listing Rule 8.201-E, which streamlines the approval process for digital asset ETFs, eliminating the need for individual SEC scrutiny.

This regulatory milestone accelerates product rollouts and enhances market accessibility. By listing on NYSE Arca, Grayscale's Ethereum Trusts gain visibility among retail and institutional investors, likely boosting liquidity and trading volumes. The move mirrors Bitcoin's trajectory, where ETF approvals catalyzed broader market participation.

Ethereum’s Seasonal Surge: August and September Outperform as Key Profit Months

Ethereum has solidified its position near the $4,174 mark, with September emerging as its most lucrative month this cycle. The asset’s 18.7% August rally marked its strongest monthly gain in years, while December projections hint at even higher returns—though trader sentiment remains anchored to late-summer momentum.

The blockchain’s utility as a decentralized computing platform continues to differentiate it from Bitcoin’s payment-focused model. At press time, ETH trades at $4,174, reflecting a 7.25% dip from recent highs.

September’s price action proved particularly rewarding for tactical investors. Those who entered during May’s recovery phase captured maximum gains as ETH breached $4,000 by month’s end. CoinMarketCap data reveals this pattern: a January trough giving way to sustained recovery through Q2, culminating in Q3’s decisive breakout.

FalconX Launches Ethereum Staking Yield Derivatives for Institutional Investors

FalconX has pioneered forward rate agreements tied to Ethereum's staking yields, marking a significant development in crypto derivatives. The contracts reference Treehouse's TESR benchmark, part of a broader effort to establish crypto-native rate standards akin to traditional finance's Libor.

Institutional demand for yield management tools grows as Ethereum validator queues hit two-year highs. Over $1 billion has flowed into staking derivatives products year-to-date, with TESR-based instruments offering non-US clients exposure to ether's native yield without direct staking complexity.

The launch coincides with volatile staking returns - annualized yields fluctuated between 3.2% and 5.8% this quarter. Treehouse's daily rate publication provides the transparency institutions require when hedging exposure to crypto's evolving yield curves.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market developments, here are projected price ranges for Ethereum:

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $3,800-$4,500 | $4,200-$5,000 | $5,000-$6,000 | ETF flows, staking adoption |

| 2030 | $8,000-$12,000 | $12,000-$18,000 | $18,000-$25,000 | Scaling solutions, DeFi growth |

| 2035 | $15,000-$25,000 | $25,000-$40,000 | $40,000-$60,000 | Enterprise adoption, Web3 expansion |

| 2040 | $30,000-$50,000 | $50,000-$80,000 | $80,000-$120,000 | Global digital infrastructure role |

BTCC financial analyst Ava emphasizes that 'These projections assume successful implementation of Ethereum's roadmap, particularly regarding scalability solutions. Short-term volatility should be expected, but the long-term trajectory remains positive given Ethereum's established ecosystem.'